Ballet Austin Foundation

In 1998, visionary community leaders established the Ballet Austin Foundation (BAF) to create a permanent endowment fund. This fund provides reliable grant support annually to all aspects of Ballet Austin and its principal is never spent. A separate 501(c)(3) led by its own Board of Trustees and Advisory Council, the BAF is managed by Fiducient Advisors.

How it Works

For more than 25 years, the BAF has carefully nurtured the generosity of donors like you, building a strong and stable endowment that helps Ballet Austin thrive now and in the future — even in, and especially in, uncertain times.

The annual grant to Ballet Austin is determined through a conservative formula which takes into account a 3-year average of account value, applies a percent for consideration, and then nets out expenses.* In 2004, the value of the fund reached $1M and the first grant was made to Ballet Austin in the amount of $25,000. Now, including the Butler New Choreography Endowment**, the fund grants Ballet Austin over $350,000 each season!

*Formula details available on request. **Butler New Choreography Endowment included in totals.

Ways to Give

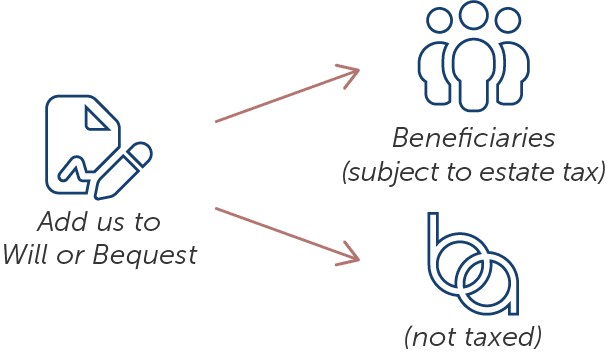

Leave a gift in your will or trust as a dollar amount, percentage of your estate, or specific assets.

DEFINITION: A charitable bequest is a way to donate assets to a charity after your death, specified in your will or trust agreement. It can be a fixed dollar amount, a percentage of your estate, or specific assets.

EXAMPLE: Sue grew up attending The Nutcracker and then began taking her daughter. Now, Sue, her daughter and her granddaughter have a tradition of attending Ballet Austin’s production of The Nutcracker every year. In honor of this special tradition, Sue provided in her will that one third of her estate would be given to the Ballet Austin Foundation, ensuring the future of Ballet Austin and The Nutcracker.

Benefit to you:

You have control of your assets during your lifetime.

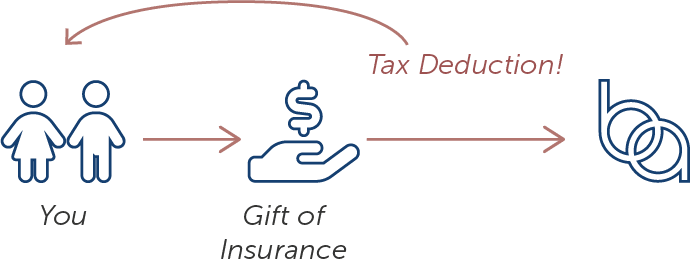

Name the BAF as the beneficiary of a life insurance policy — or transfer ownership of an existing policy — to make a lasting gift.

DEFINITION: A gift of life insurance to a charity is a method of donating to a non-profit organization by naming it as the beneficiary of a life insurance policy. The charity will receive the policy’s death benefit after the insured’s death. This can be done by transferring ownership of an existing policy to the charity.

EXAMPLE: Steve owns a life insurance policy he no longer needs. He learns that if he names the Ballet Austin Foundation as the owner and beneficiary of the policy, he can deduct the cash value of the policy now as well as leave a generous gift to the Ballet Austin Foundation in the future.

Benefits to you:

- You receive the immediate income tax deduction for the cash value of the policy.

- You are able to make a generous gift to the BAF without affecting your cash flow.

- As a result of transferring ownership of a life insurance policy to the Ballet Austin Foundation, the Foundation will later receive the death benefit of the policy.

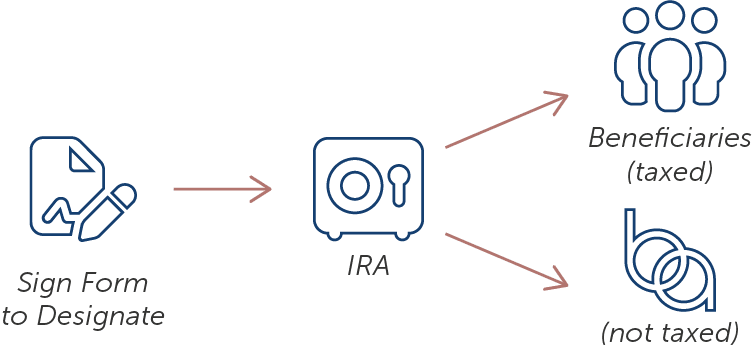

Name the BAF as a beneficiary of your IRA so remaining assets support our mission after your lifetime.

[/vc.column_text]

EXAMPLE: Jennifer is employed with a company that offers a 401(k). She is thinking about ways to support Ballet Austin in the future and learned she can name the Ballet Austin Foundation as a beneficiary of her 401(k). After she retires, she will withdraw funds as needed for living expenses and can leave a portion or all of the remaining balance to the BAF upon her passing.

Benefits to you:

- You can continue to make withdrawals during your lifetime.

- You can change beneficiaries at any time.

- Unlike individual beneficiaries would, the Ballet Austin Foundation does not pay income tax on the retirement benefits it receives. Therefore, the retirement benefits passing to the Ballet Austin Foundation at your death avoid income taxation. If you were planning to benefit Ballet Austin under your estate plan, doing so through your retirement benefits offers a tax-efficient way to accomplish this goal.

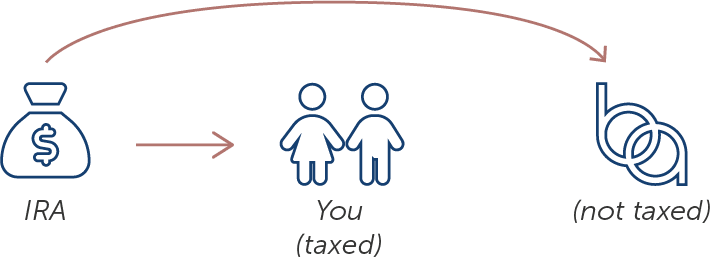

Give some/all of your IRA’s Required Minimum Distribution (RMD) and lower your taxable income.

DEFINITION: A Qualified Charitable Distribution (QCD) is a direct transfer of funds from an IRA to a qualified charitable organization.

EXAMPLE: Mark and Julie are in their mid-70s. They are retired, but they do not need all of the required minimum distributions (RMDs) they must take annually from their IRAs. They decide to make a donation to the BAF by directing their required distribution amounts (up to $108,000 per individual) to the Ballet Austin Foundation, thus avoiding payment of income tax on the gifted amount and benefiting the BAF.

Benefits to you:

- At age 70 ½ and older, you can direct that up to $108,000 be distributed annually from your IRA to BAF; and if you are age 73 or older, this distribution will count toward satisfying the required minimum distribution (RMD) you must take each year from your IRA.

- Your taxable income is lower due to the contribution, which, in turn, may reduce your applicable tax rate and increase access to other tax benefits.

*Note: A gift in the form of a Qualified Charitable Deduction does not offer a tax deduction, rather it reduces taxable income.

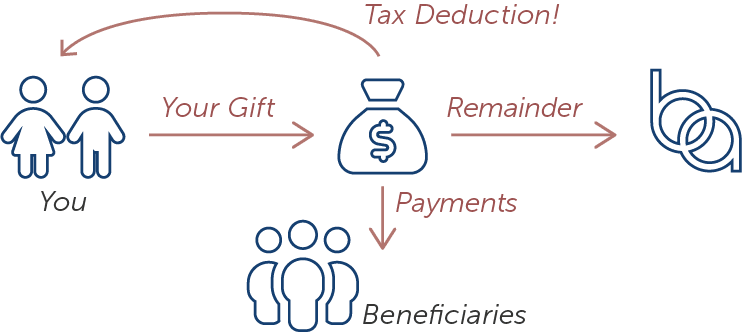

Create an irrevocable trust that provides you or a loved one with income for life or a set term — with the remaining assets going to the BAF.

DEFINITION: A Charitable Remainder Trust (CRT) is a type of irrevocable trust that allows a donor to make a gift to charity while receiving income for life or a set period. The trust holds assets, like real estate, and provides a stream of income to the donor or beneficiary(ies). After a specified period, the remaining assets in the trust are distributed to one or more charities.

EXAMPLE: Jane and John have stock worth $75,000 for which they originally paid $35,000. They learn they can support the Ballet Austin Foundation by donating this stock to a charitable remainder trust. They defer the tax on the $40,000 capital gain and receive an income tax deduction this year for a portion of the amount contributed to the trust. They also receive annual payments for the rest of both their lives. The balance of the trust is donated to the Ballet Austin Foundation.

Benefits to you

- You receive an immediate income tax deduction for a portion of your contribution to the trust.

- You or your designated beneficiaries receive a predictable, stable income for life or a specified term.

- You defer payment of the capital gains tax on appreciated assets you donate that are sold.

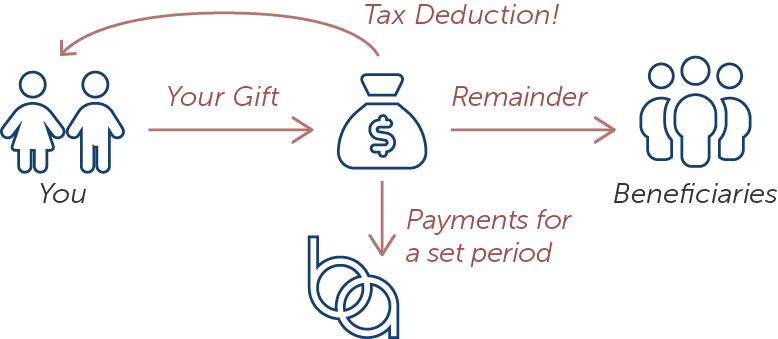

Transfer assets to a trust that provides income to the BAF for a set period — then passes the remaining assets to your heirs or other beneficiaries.

DEFINITION: A charitable lead trust (CLT) is a type of irrevocable trust where a donor transfers assets to a trust, and a charity receives income from the trust for a set period. After that period, the remaining assets are distributed to a non-charitable beneficiary, who could be the donor, their family, or other individuals. CLTs are often used to reduce estate taxes and provide a tax deduction for the donor.

EXAMPLE: Mike establishes a lead trust, valued at $500,000, to benefit the Ballet Austin Foundation. The trust will pay the BAF an annual distribution of 5% of the trust’s value for 15 years, starting with an initial payment of $25,000. After 15 years, the remainder of the trust passes to Mike’s family.

Benefits to you:

- You transfer assets to a trust that makes fixed payments to the Ballet Austin Foundation for a specified term. When the trust ends, the principal goes to your chosen beneficiaries.

- The portion of the contribution benefitting the Ballet Austin Foundation is eligible for the gift tax charitable deduction, and the gift tax consequences can be reduced based on the structure of the annuity payments and the term of the trust.

- The contributed assets and their appreciation are removed for your taxable estate for estate tax purposes, providing you an opportunity to leverage your estate tax exemption to shelter assets expected to appreciate.

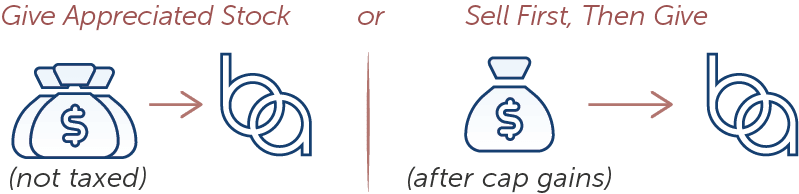

Donate stocks or securities that have increased in value since you purchased them.

DEFINITION: Donation of securities that have increased in value since their purchase to a charitable organization.

EXAMPLE: Bob and Kathy have been involved with Ballet Austin for a long time. They are Season Ticket Holders and annual donors. They have a vested interest in the organization and would like to help support its future. They have appreciated stock on which they face paying a capital gains tax upon sale. By donating their stock to support Ballet Austin productions they may be able to reduce or eliminate the capital gains tax.

Benefits to you:

- You receive the tax deduction of the current market value of the stock at the time of your gift depending on your adjusted gross income and contribution base.

- You will not owe capital gains tax on your stock’s appreciation.

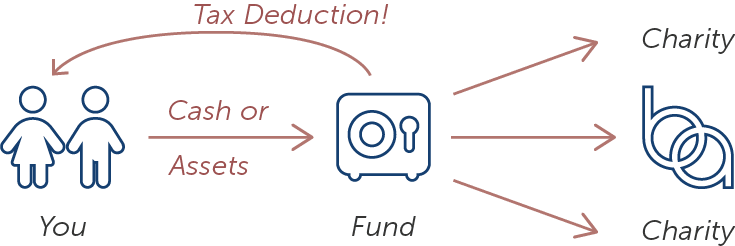

Give through a DAF — a charitable account managed by a public charity — and recommend grants over time.

DEFINITION: A charitable giving vehicle where individuals or organizations make contributions to a fund, which is then managed by a public charity.

EXAMPLE: Anne grew up dancing and has been a long-term supporter of Ballet Austin. She sold her company this year so owes significant income taxes. Anne can set up a Donor Advised Fund and donate cash or appreciated stock to her Fund and receive a tax deduction this year when she will benefit the most from the charitable deduction. Assets inside her fund are invested and grow income tax free, and Ann can direct annual distributions from her Fund to support the Ballet Austin Foundation.

Benefits to you:

- You can minimize your income tax liability while meeting your philanthropic goals for years to come.

- You control when and how much to give to the public charities of your choice.

Make the simplest gift — by check, credit card, or wire transfer — to support the Ballet Austin Foundation right away.

DEFINITION: A gift of cash, whether by check made payable to the Ballet Austin Foundation or wire transfer (instructions available upon request), is the easiest way to contribute to the Ballet Austin Foundation (“BAF”). The BAF’s account’s principal is never spent and is carefully managed by its own Board of Trustees and Fiducient Advisors.

Below is the information you may need for these types of donations:

Official legal name: Ballet Austin Foundation

Federal EIN number: 74-2884031

Mailing address:

501 W. 3rd Street

Attn: Development Department

Austin, TX 78701

When you become a donor to the Ballet Austin Foundation, you:

Your generosity today becomes the standing ovation of tomorrow!

The Ballet Austin Foundation is deeply grateful for your foresight — and honored to carry your legacy forward.

If you choose to make a gift now (or during your lifetime), you can become a BAF Visionary*, deepening your connection to Ballet Austin and its enduring mission. Those who choose to make a gift that would be realized beyond their life join the BAF Legacy Circle.

*BAF Visionaries give $50,000+ to the BAF during their lifetime. Gifts of any size, however, are welcome.

All donors enjoy recognition and invitations to become more deeply engaged with Ballet Austin.

If you are interested in supporting the Ballet Austin Foundation (Tax ID #74-2884031) contact Christi Lotz, Development Director, at christi.lotz@balletaustin.org or 512.476.9151, ext. 124.

Leadership

Cathy Thompson, Chair

Edie Rogat, Vice Chair

Diane T. Land, Treasurer

Sarah Butler, Secretary & Founding Chair Emeritus

Cliff Ernst, Legacy Circle Chair

Jennene Mashburn

Emily Moreland

Dr. Joaquin Delgado, Ex Officio, Ballet Austin President

Nikki Bryant, Ex Officio, Ballet Austin Treasurer

Paula N. Boldt · Jeff Coddington · Renée Gallagher · Janette Keating · Alexander C. Ladage · Judy Matula · Elizabeth T. Powdrill · Ryann Reaud · Stephanie Whitehurst

Legal Advisor

Derry Swanger, Swanger Prickett LLP

Financial Advisor

Jon Fellows, Fiducient Advisors

Ballet Austin Foundation Thanks Our Endowment Donors

$6,000,000+

Sarah & Ernest Butler

$100,000+

Anonymous

In loving memory of Nancy Lee Carpenter

Ballet Austin Board of Directors

Ballet Austin Guild

Janette & Patrick Keating

Joe R. & Teresa Lozano* Long

Jennene Mashburn, In loving memory of K. Ray Mashburn

$50,000+

Anonymous

In honor of Sarah Butler, 2022 BAF Trustees and Advisory Council Members

In loving memory of Martha B. Harrington

In loving memory of Terri Lynn Wright

The Kuglen Foundation, Dr. & Mrs. Craig Kuglen

Edie Rogat & Cotter Cunningham

Peter Schram* & Harry Ullman*

Cathy & Dwight Thompson

$25,000+

Steve Adler & Diane T. Land

Linda Ball & Forrest Preece

Barbara & Alan Cox, In memory of James Alan Cox

Martha & Cliff Ernst

Malcolm Ferguson*, In memory of Marilyn H. Ferguson

Jo & Jonathan Ivester

Catherine Leon-Parker

Emily Moreland / Moreland Properties

Legacy Circle Members

Steve Adler & Diane T. Land

Linda Ball & Forrest Preece

Becky Beaver

Rick Bennett

Paula Boldt

Nikki Bryant Irion & Terry Irion

Sarah & Ernest Butler

Darlene & Daniel H. Byrne

Ann & James Downing

Dorothy Drummer

Martha & Cliff Ernst

Dr. Harvey Evans* & Gloria Evans*

Malcolm Ferguson*

Jennifer Guthrie

David L. Harrington

Ann Marie Harrison*

Becky & Richard Herrington

Caroline C. Jones

Alexander C. Ladage

Leon* & Laraine Kentridge Lasdon

Mike Baryshnikov Le Burkien

Julie Koenig Loignon

Catherine Leon-Parker

Dell Marcoux*

Jennene & K. Ray* Mashburn

Michael Ellwood Owens

Charles A. Phillips

Joanne M. Ravel*

Wanda A. Reynolds

Cookie & Phil Ruiz

Eddie Safady

Rosemarie Schwarzer

Jare & Jim* Smith

Karen Sonleitner

Mary & Bruce* Walcutt

J. Craig Wallace

Stephanie & Bill Whitehurst

*In memoriam

Learn more about supporting the Ballet Austin Foundation (Tax ID #74-2884031) by contacting Christi Lotz, Development Director, at christi.lotz@balletaustin.org or 512.476.9151, ext. 124.